IMF Upgrades India Growth 2025-26 Outlook Amid Global Economic Challenges

IMF Upgrades India Growth 2025-26: India’s economy is back in the spotlight. The IMF’s latest World Economic Outlook has upgraded India’s growth forecast for fiscal year 2025‑26 (FY26) to 6.6 %, up from its earlier 6.4 % projection — a sign of confidence in the country’s resilience despite rising global headwinds.

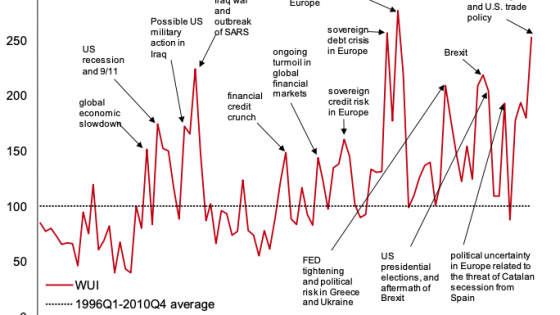

Yet the upward revision comes in a complex global setting — with U.S. tariff pressures, shifting trade norms, geopolitical uncertainties, and risks of external demand slowdown. What lies beneath the headline? This article examines the drivers, the vulnerabilities, sectoral outlooks, policy implications, and what it means for India’s trajectory in a fragile global economy.

Drivers of the Upgraded Growth Forecast

Strong Private Consumption and Investment

The IMF’s upgraded forecast rests significantly on a rebound in private consumption in the first quarter of FY26, which outperformed expectations and partly offset export headwinds.

Additionally, modest acceleration in private and public investment, especially in infrastructure and digital sectors, bolstered the outlook.

Resilience to External Pressures

Despite heightened U.S. tariffs on Indian exports introduced mid‑2025, India’s domestic demand cushion and diversified export base helped mitigate some external shock.

Also, policy flexibility in handling exchange rates, liquidity, and trade measures gave India more buffer.

Services and GCC Strength

India’s services sector remains a strong export engine, especially via Global Capability Centres (GCCs) that perform R&D, financial services, back‐office, and tech tasks.

Also Read: GST Rates Slashed 2025: What’s Cheaper and What It Means for You

These high‐value services exports help offset weaknesses in manufacturing and goods exports.

Regional & Global Context

The IMF also lifted Asia’s 2025 growth forecast to 4.5 %, expecting the region to contribute roughly 60 % of global growth in 2025‑26.

India, as a large economy in Asia, benefits from regional trade, supply chains, and technology diffusion.

Sectoral Outlook & Structural Trends

Manufacturing & Exports

The manufacturing sector faces pressure from global demand slowdown and tariff barriers, particularly in sectors such as textiles, metals, and electronics.

To sustain growth, India must enhance value addition, upgrade supply chains, and reduce dependency on commodity exports.

Infrastructure & Investment

Government investment in roads, ports, digital infrastructure, energy transition, and urban infrastructure will be critical.

Public expenditure can crowd in private capital if regulatory consistency and implementation improve.

Technology, AI & Innovation

Adoption of AI, advanced digital infrastructure, and tech innovation offer tailwinds for productivity growth.

India’s emerging position in software, data services, and increasingly in AI development can help leapfrog constraints.

Labor, Skill Gaps & Inclusivity

A challenge remains in aligning skill supply with demand. Reports suggest only ~45 % of engineering graduates are industry‑ready.

To convert growth into inclusive development, skill training, job creation in tier‑2/3 cities, and social safety nets are key.

Risks & Headwinds That Could Derail the Upside

U.S. Tariff Policy & Protectionism

The U.S. imposition of steep tariffs and fees, including a $100,000 H‑1B visa application charge and proposals to tax foreign service payments, could discourage offshoring to India.

Such policy shifts could limit India’s service export growth.

Global Demand & Trade Uncertainty

Weak global demand—especially in Europe, U.S., and China—poses a risk to India’s export sectors.

Moreover, geopolitical disruptions, supply chain decoupling, and trade fragmentation could raise transaction costs.

Read Also: Despite US tariff hikes

Financing, Interest Rates & Fiscal Constraints

If global interest rates rise or capital inflows become volatile, borrowing costs may rise for India’s government and private sector.

India must manage public debt carefully to maintain fiscal credibility.

External Shocks & Commodity Prices

Volatility in energy, metals, or food commodity prices could strain import bills, inflation, and balance of payments.

Given that India is a net importer of crude oil, such swings can affect inflation and subsidies.

Policy Implementation & Structural Bottlenecks

Delays in project execution, land acquisition, regulatory hurdles, and coordination across states remain persistent constraints.

Efficient governance, institutional reforms, and ease of doing business improvements are essential.

Policy Imperatives & Strategic Measures

- Trade Diplomacy & Market Diversification: India must deepen trade ties with ASEAN, Africa, Latin America, and Africa to reduce dependence on U.S. and EU markets.

- Export Incentives & Upgradation: Support value‑added exports, move up the value chain in electronics, green tech, pharmaceuticals, defense manufacturing.

- Skill Development & Education Reform: Expand vocational training, bridge skill mismatches, incentivize private participation in education.

- Infrastructure Financing & Public‑Private Partnerships (PPP): Strengthen PPP frameworks, improve project implementation speed, attract private capital into infrastructure.

- Financial Sector Stability: Ensure banking, non‑bank finance, and capital markets are resilient, with prudent risk management and regulatory oversight.

- Macro Stability & Inflation Control: Maintain credible inflation targeting, manage monetary policy carefully, and buffer external shocks via reserves.

Expert Perspectives

Renowned economist Arvind Subramanian recently emphasized that India’s growth potential lies in improving productivity rather than only demand stimulus — a structural shift is needed beyond cyclical recovery.

According to a senior IMF official, the upgraded forecast reflects India’s ability to absorb shocks and the importance of domestic strength in uncertain global times. (IMF, 2025)

Toward Global Fragility: Broader Context

Globally, the growth projection for 2025 has been revised to ~3.0 %.

Amid fragmented geopolitics, trade realignments, and supply chain tensions, regional economies like India become critical anchors of growth.

The IMF’s raise for Asia and India signals that even in a volatile world, nimble, demand‑driven economies may outperform.

True Growth Lies Beyond the Material

From the lens of Satgyan, material growth and worldly prosperity are transient; true knowledge lies in inner spiritual awakening. While India’s economic growth offers opportunities for better living standards, Satgyan teaches that lasting peace, ethical conduct, and inner transformation transcend monetary success and should guide society’s progress even amid development.

India’s 2025-26 Growth Opportunities

India’s upgraded 6.6 % growth forecast for FY 2025‑26 signals robust domestic momentum amid external challenges. While strong consumption, resilient services exports, and policy flexibility are major positives, risks from U.S. tariff policy, global demand weakness, and structural constraints loom large. Success depends on decisive reforms in infrastructure, education, trade, and governance. If India navigates these headwinds well, it can further cement itself as a growth engine in a fragmented global economy.

FAQs: India’s 2025-26 Growth Outlook

Q1: What does the 6.6 % growth forecast refer to?

It refers to India’s projected Gross Domestic Product (GDP) growth in the fiscal year 2025‑26 (FY26), as revised by the IMF.

Q2: Why did the IMF raise the forecast now?

Because India’s private consumption in the first quarter exceeded expectations, and the economy showed resilience despite export and tariff headwinds.

Q3: What are Global Capability Centres (GCCs) and why are they important?

GCCs are offshore hubs (by multinational corporations) in India handling knowledge‑intensive tasks like R&D, analytics, financial services. They generate high-value employment and export revenue.

Q4: What main risks could derail this growth?

Major risks include steep U.S. tariff measures, weakening global demand, external shocks to commodity prices, rising interest rates, and domestic implementation bottlenecks.

Q5: How can India sustain this growth trajectory?

Key strategies include diversifying export markets, strengthening infrastructure and institutional reform, investing in skills and education, embracing innovation, and ensuring macroeconomic stability.

Discussion (0)