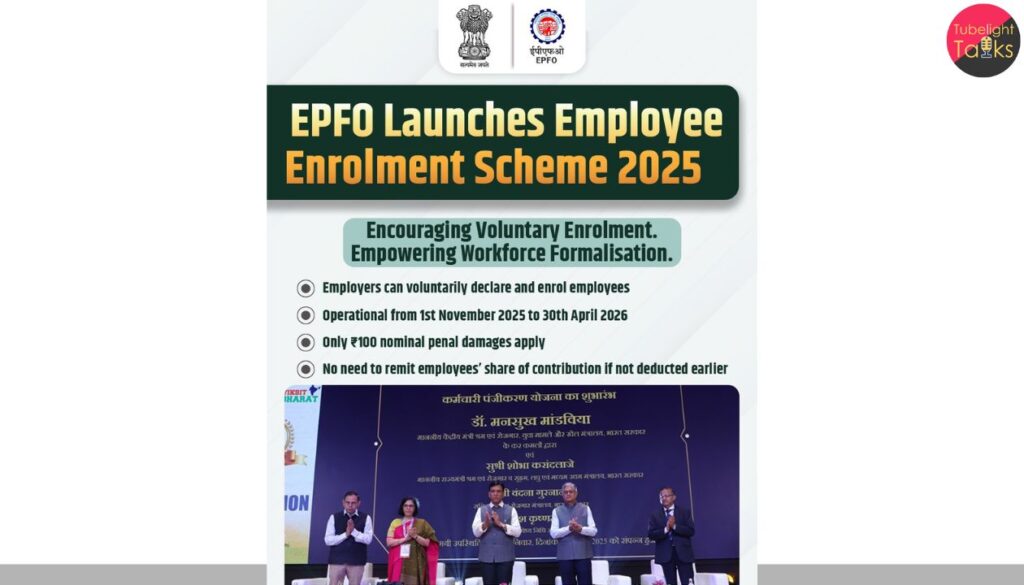

EPFO Employees’ Enrolment Scheme 2025: Who Qualifies, What’s Waived, and How to File Before April 30, 2026

The EPFO Employees’ Enrolment Scheme 2025 (EEC-2025) is a six-month EPFO compliance window running November 1, 2025 to April 30, 2026. It lets employers voluntarily enrol eligible employees left out of EPF coverage between July 1, 2017 and October 31, 2025, with employee share waived (if not deducted earlier), nominal ₹100 damages, and the employer remitting its share with Section 7Q interest and admin charges.

Declarations are online, tied to UMANG face-authenticated UANs and ECR/TRRN for payment. Linked benefits under PM-VBRY may apply to eligible employers. This explainer lays out eligibility, costs, step-by-step filing, and risk checks, with official references.

What is EPFO’s EEC-2025 and why now?

The Ministry of Labour & Employment announced the Employees’ Enrolment Scheme 2025 to expand social security and make it easier for employers to regularize past records with minimal penal burden. Officially, the government states the scheme “shall be operational from November 1, 2025, to April 30, 2026.”

“Scheme to be operational from November 1, 2025, to April 30, 2026.” (PIB/EPFO press brief)

The Labour Minister launched EES-2025 during EPFO’s 73rd Foundation Day in New Delhi, underscoring the administration’s intent to broaden EPF coverage and support voluntary compliance.

Who can participate under EEC-2025?

Eligible establishments

All establishments—already covered or newly coming under the EPF & MP Act—are eligible to participate, even if inquiries under Section 7A, Para 26B (EPF Scheme) or Para 8 (EPS, 1995) are ongoing. (If the declaration pertains to the period under inquiry, the campaign benefit is limited to the ₹100 damages cap.)

Eligible employees

Employers may declare and enrol employees who:

- Joined the establishment between July 1, 2017 and October 31, 2025,

- Were eligible for EPF but not enrolled earlier, and

- Are alive and in employment on the date of declaration.

Note on exits: No suo motu EPFO action is to be initiated for those who exited prior to the declaration, subject to full declaration of all eligible current employees and no unpaid dues where contributions were deducted.

What costs are waived—and what must be paid?

Waiver highlights

- Employee’s share of retrospective contribution stands waived for the declared period if it was not deducted earlier from wages.

Payable by employer

- Employer’s share for the applicable past period, plus interest under Section 7Q and administrative charges.

- Damages across EPF, EPS and EDLI are capped to a lump-sum ₹100 per establishment under the campaign.

The official PIB notes and EPFO FAQ make this relief structure clear, balancing formalization with accountability.

One-time declaration only—so plan it right

An employer may file only one declaration under EEC-2025. Map every eligible employee before filing so you don’t miss anyone and forego the campaign’s protections.

Step-by-step: How to file under EEC-2025 (with UMANG & EPFO portal)

Prep your data

- Compile the list of all eligible employees (7/1/2017–10/31/2025) still on rolls. 2) Confirm no employee share was deducted—if deducted, you must deposit it. 3) Verify KYC (Aadhaar, bank) to avoid return-to-bank issues.

Generate or verify UANs with Face Authentication

Per EPFO’s Revised FAQ, employers must generate a Face Authentication-based UAN using the UMANG app for each declared employee (or verify existing UAN). This aligns with EPFO’s push to route UAN generation/activation via UMANG for security and convenience.

File online and link payments correctly

- Log in to the EPFO portal, file the EEC-2025 declaration online, and generate a TRRN.

- Upload and submit ECR (Electronic Challan-cum-Return) for the campaign period, ensuring line-item accuracy.

- Pay employer share + Section 7Q interest + admin charges, and ₹100 damages as prescribed.

Keep artefacts & proofs ready

Maintain board approvals/management notes, employee lists, payroll proofs, ECR acknowledgements, bank challans, UAN screenshots, and a copy of the declaration in case of audit or inquiry.

Dates & timeline at a glance

- Window open: Nov 1, 2025

- Window closes: Apr 30, 2026 (declarations beyond this date won’t qualify)

- Coverage period for enrolment: July 1, 2017–Oct 31, 2025

Linkage with PM-VBRY (hiring incentive)

Employers registering afresh or declaring additional employees under EEC-2025 may be eligible for benefits under Pradhan Mantri-Viksit Bharat Rozgar Yojana (PM-VBRY), subject to PM-VBRY T&Cs. If you’re planning new hires alongside the declaration, evaluate this add-on benefit.

Risk checks, red flags & good-faith compliance

- False declarations void the relief ab initio and may invite penal action under the EPF & MP Act and Schemes. Be accurate and transparent.

- If employee share was deducted earlier, it must be deposited—no waiver applies to already-deducted sums.

- If your declaration overlaps an ongoing inquiry period, the only relief available is the ₹100 damages cap; all dues and interest still apply.

Practical scenarios

A services startup with missed interns (later regularized)

Employees joined in 2019–2020 as trainees, regularized in 2021. They met EPF eligibility then but weren’t enrolled. Under EEC-2025, the employer can declare those still on rolls, pay employer share + Section 7Q interest + admin charges, and deposit any employee share that was deducted (waiver applies only if not deducted). Damages limited to ₹100.

A small manufacturer under Section 7A inquiry

The factory is facing a 7A inquiry for 2018–2021. It can still file an EEC-2025 declaration. Where the declaration period overlaps the inquiry period, the scheme benefit is limited to ₹100 damages; otherwise, regular EEC-2025 terms apply.

Retail chain: some employees left earlier

If some eligible employees have left, no suo motu action will be taken for those who exited prior to declaration, provided all current eligible employees are declared and there are no unpaid deducted dues.

Why EEC-2025 matters (beyond “amnesty”)

EEC-2025 continues the compliance-encouragement approach of the 2017 enrolment drive, but updates it to today’s digital stack—UMANG, face authentication, TRRN-linked ECR—and connects with employment incentives (PM-VBRY) for wider formalization. It is a time-bound chance to correct legacy misses without heavy punitive damages—and to protect workers’ long-term savings.

The official text and notifications you should bookmark

- PIB Launch Note (Nov 1, 2025) and PIB Announcement (Oct 13, 2025) summarizing the scheme.

- EPFO Press PDF (Launch) and Revised FAQ (EEC-2025) for the operative nuts-and-bolts.

- Notification G.S.R. 749(E) and implementing circulars hosted on EPFO’s circulars page.

- Minister’s launch update on X (for a quick official signal).

Compliance with Compassion and Fairness

Regularizing past EPF coverage is not just a legal task; it reflects fairness, truthfulness and duty of care to people whose futures depend on social-security savings. Spiritual leader Sant Rampal Ji Maharaj Spiritual discourses often urge employers and employees alike to work honestly, eschew exploitation, and ensure just dues are paid promptly—principles that resonate with EEC-2025’s intent to formalize without harsh punishment.

In talks addressed to both employers and workers, Sant Rampal Ji Maharaj stresses honest earnings and righteous conduct; one video explicitly discusses “ideal behaviour for employer & employees,” while texts like Way of Living emphasize earning by honest work and compassion in everyday decisions. Bringing that ethic into HR decisions—choosing transparency, correcting mistakes, and protecting livelihoods—turns a compliance task into values-driven governance.

Act Now: File Your EEC-2025 Declaration Before April 30, 2026

A 6-Month Window for Clean-up, Culture-Shift and Confidence

- Start this week: Freeze the list of eligible employees (7/1/2017–10/31/2025), verify they are currently on rolls, and check whether any employee share was deducted.

- Go digital: Arrange UMANG access for Face Authentication-based UAN generation/verification; align payroll, HRMS and KYC data for smooth ECR/TRRN flows.

- Budget the outgo: Compute employer share + Section 7Q interest + admin charges; set aside ₹100 for campaign damages.

- Use the incentive stack: Check whether PM-VBRY benefits apply to your establishment post-enrolment or new hiring.

- Communicate values: Tell your workforce why you’re doing this—because formal savings matter and doing the right thing matters more.

- Don’t wait: Declarations filed after April 30, 2026 won’t qualify for EEC-2025 relief.

FAQs: EPFO Compliance Window

Q1. What is the EEC-2025 window and who announced it?

It’s a six-month EPFO compliance window from Nov 1, 2025 to Apr 30, 2026, launched by the Ministry of Labour & Employment/EPFO to expand EPF coverage.

Q2. Which employees can be declared?

Those who joined between July 1, 2017 and Oct 31, 2025, were eligible but not enrolled, and are alive and employed on the declaration date.

Q3. What gets waived? What must be paid?

Waived: Employee share if not deducted earlier. Payable: Employer share + Section 7Q interest + admin charges; damages capped at ₹100 across EPF/EPS/EDLI.

Q4. Can I file multiple declarations?

No. Only one declaration is allowed under EEC-2025, so include all eligible employees in one go.

Q5. What if we’re under a Section 7A inquiry?

You can participate. Where the declaration overlaps the inquiry period, the campaign benefit is limited to ₹100 damages; dues/interest still apply.

Q6. Are there linked benefits like PM-VBRY?

Yes. Employers registering or declaring employees under EEC-2025 may be eligible under PM-VBRY, subject to that scheme’s terms.

Discussion (0)