Fundamental Tax-Saving Provisions: How To Save Tax Legally in India?

Tax Planning is a significant aspect of personal finance management. The Indian tax system offers various options for individuals and businesses to save taxes legally. However, in order to have a roadmap to effective tax saving strategies, it is necessary to understand the basic tax structure in India. Explore, in a nutshell, how one can save tax in India through valid legal provisions.

Tax Structure in India

In India, taxes are levied on the income, wealth and property of every individual in India, irrespective of the fact whether the individual is a resident or non-resident of India.

In general terms, income tax is a share of an individual’s income that is paid to the government in the form of taxes or deductions to be utilised for administrative purposes.

As per the Income tax Act and Rules, an individual’s income is taxed under five heads:

- Income from salary

- Income from house or property

- Income from profits of business or profession

- Income from capital gains

- Income from other sources

The Income tax Act, 1961, divides the taxpayers into different slabs based on their income levels. As of the financial year 2023-24, there are two tax regimes prevailing in India, the old tax regime and the new tax regime. Taxpayers are free to choose either depending on needs and benefits.

Old Tax Regime v/s New Tax Regime

- The Old Tax Regime allows various deductions and exemptions, including House Rent Allowance (HRA). Whereas, standard deduction in salary is not available in the new tax regime.

- The tax rates applicable in the new tax regime are significantly lower than that in the old tax regime.

Tax Slabs for Individuals (FY 2023-24)

| Income | Rates (Old tax regime) | Rates (New tax regime) |

| Up to 2.5 lakh | Nil | Nil |

| 2.5 lakh to 5 lakh | 5% | 5% |

| 5 lakh to 10 lakh | 20% | 10% |

| Above 10 lakh | 30% | 30% |

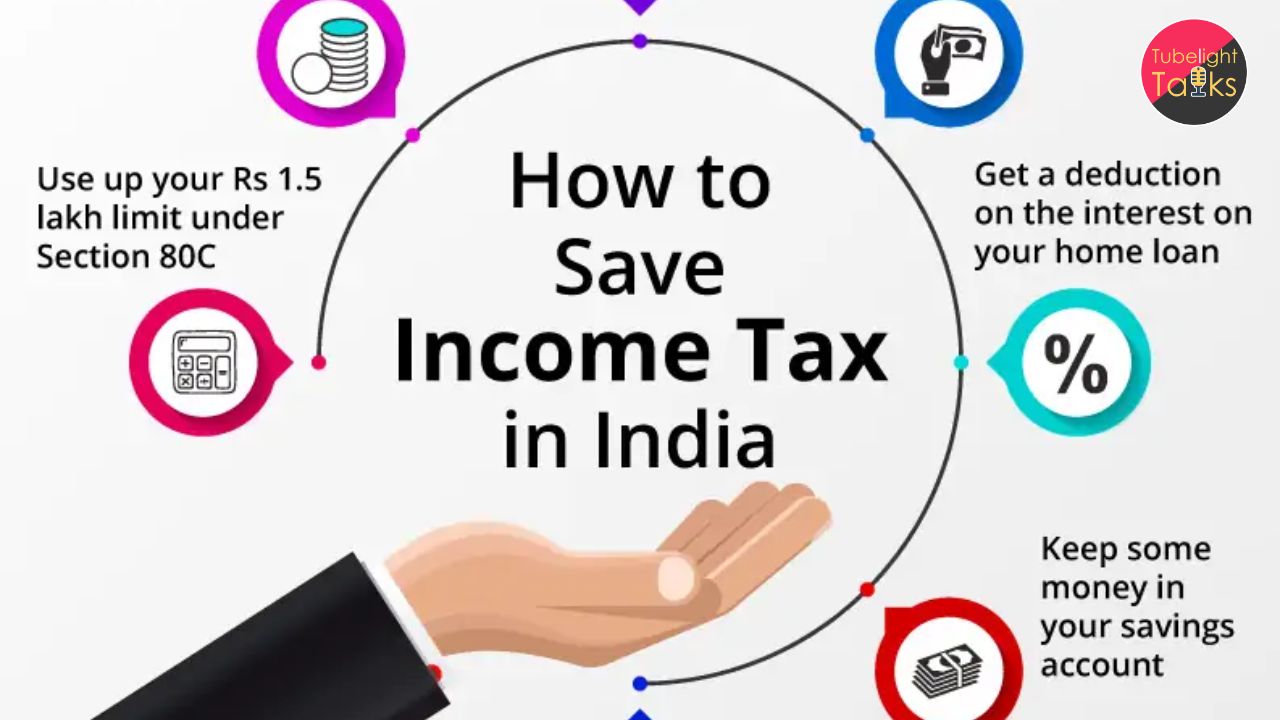

Key Tax-Saving Provisions

Let’s comprehend the deductions available in Income Tax Act, 1961 to save taxes.

Deductions available under Section 80

Tax- saving instruments

Under Section 80C, individuals can avail a maximum deduction of up to INR 1.5 lakh in eligible investments including Public Provident Fund (PPF), Employee Provident Fund (EPF), National Pension Scheme (NPS) and many more.

Avail tax benefit on Health Insurance – Section 80D

- For self and family: a maximum deduction for health insurance of INR 25,000, and INR 50,000 in case of senior citizens, can be availed.

- For parents: Up to INR 25,000, and 50,000 in case of senior citizens, can be availed.

Tax benefit on educational loans – Section 80E

- Under this section, taxpayers can avail a deduction on the interest paid on educational loans taken for higher studies benefit of which is available for 8 years.

Donations made in specified funds – Section 80G

- This section enables taxpayers to make donations made to specified funds, charitable institutions, etc., and are eligible for deduction such as:

- 100% deduction: Can be availed in funds like Prime Minister National’s Relief Fund, National Foundation for Communal Harmony, etc.

- 50% deduction: Can be availed when donations to other specified charitable institutions are made.

Tax benefits related to HRA (House Rent Allowance)

An individual staying in rented accommodation is eligible to claim the HRA exemptions under Section 10 (13A).

The exempt amount will be the least of:

- Actual HRA received

- The value obtained from the formula: Rent paid – 10% of Salary

- 50% of the sum of basic salary and dearness allowance for metro cities and 40% of the sum of basic salary and dearness allowance for non-metro cities.

Tax benefits on Capital Gains

Selling a property can generate a long term capital gain which increases the tax liability. The Income tax Act,1961, offers certain provisions or exemptions to reduce the tax burden.

Exemption under Section 54 and Section 54EC

- Section 54 offers exemptions on the capital gains arising from sale of residential property if the proceeds are reinvested in another residential property within a period of 1-2 years after the sale.

- Section 54EC offers exemptions on the capital gains earned from the sale of any other asset such as gold, jewellery, shares, debentures, etc. To claim this, one needs to invest the entire sale proceeds in notified government bonds within six months of the sale.

Salvage Your True Wealth

What is the actual purpose of material wealth in our lives? Sant Rampal Ji Maharaj sheds light on the precarious nature of wealth when accumulated beyond the basic needs of an individual.

By adopting tax saving strategies, one can aim for a better financial future, but along with this it is crucial to safeguard the wealth of our precious human life. Instead of solely focusing on material wealth, one should also aim at amassing spiritual wealth. True spiritual gains can be attained only under the refuge of a Tatvdarshi Sant. Currently, Sant Rampal Ji Maharaj is the singular Complete Saint in this world, possessing the complete knowledge of all the sacred scriptures across religions.

Sant Rampal Ji Maharaj teaches us about the importance of pursuing the authentic worship of Supreme God Kabir. Only the worship of God Kabir can salvage this precious birth as a human.

To understand more about the most effective path of worship, visit www.jagatgururampalji.org

Discussion (0)