U.S. Supreme Court Strikes Down Trump’s Global Tariffs – And Washington’s Next Move Is Already Here

In a consequential decision with global ripple effects, the U.S. Supreme Court Blocks Trump’s Global Tariffs that were imposed under the International Emergency Economic Powers Act (IEEPA). The 6–3 ruling draws a sharp line between emergency economic tools and Congress’s constitutional authority over duties and taxes.

Within hours, the White House signaled it would not abandon tariffs as a strategy – announcing a temporary, across-the-board import surcharge using a rarely used provision of the Trade Act of 1974. For businesses, exporters, and trading partners like India and China, the question now is not “tariffs or no tariffs,” but “which legal route – and how fast?”

What the Supreme Court Decided

The case behind the headlines

The ruling comes from Learning Resources, Inc. v. Trump, consolidated with Trump v. V.O.S. Selections, Inc. – a challenge brought by small businesses and multiple U.S. states arguing that IEEPA does not authorize the President to impose tariffs.

At the center is a deceptively simple question: Does IEEPA’s power to “regulate… importation” include the power to levy tariffs (taxes on imports)? The Supreme Court’s answer was direct: “IEEPA does not authorize the President to impose tariffs.”

Why IEEPA wasn’t enough, according to the Court

IEEPA has historically been used for actions like sanctions, blocking assets, and restricting transactions – not for broad, revenue-raising import taxes. The Court emphasized that the Constitution gives Congress the power to levy “Taxes, Duties, Imposts and Excises,” and the Executive cannot claim that authority without clear congressional authorization.

A major theme in the opinion is the idea that ambiguous statutory language cannot be stretched into a massive delegation of taxing power. The Court noted that when Congress delegates tariff authority, it typically does so explicitly and with guardrails – something it did not do in IEEPA.

The 6–3 split and what it signals

Chief Justice John Roberts authored the ruling, and Reuters reported that the majority included Justices Gorsuch and Barrett alongside the three liberal justices (Sotomayor, Kagan, Jackson).

The dissent – led by Justice Kavanaugh and joined by Justices Thomas and Alito – argued that the ruling primarily invalidates the use of IEEPA for these tariffs, while leaving open other statutory routes for the President to pursue tariffs.

This split matters because it hints at what comes next: the Court is narrowing one legal pathway (IEEPA), not necessarily banning tariffs as a policy tool.

Immediate Impact: Tariffs Halted, Refund Questions Begin

What changes right now at ports and in contracts

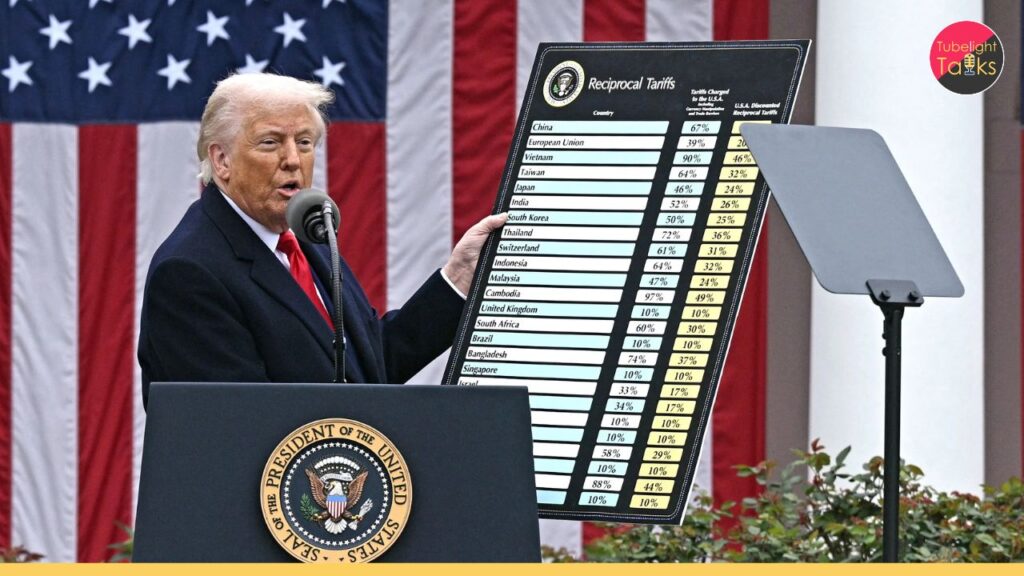

The immediate practical effect is that tariffs specifically justified under IEEPA – especially the sweeping “reciprocal” duties – cannot continue under that statute. Reuters described the decision as a major setback with “major implications for the global economy,” given how broadly the duties had been applied across trading partners.

For importers, the first concerns are operational:

- Will Customs stop collecting those duties immediately?

- How will entries already in transit be treated?

- What happens to contracts priced assuming a tariff cost?

The Court ruling itself doesn’t run the ports, but it creates an urgent need for executive and agency guidance.

The giant unanswered question: refunds

One of the biggest financial issues is refunds. Reuters reported estimates that more than $175 billion in IEEPA-based tariffs had been collected, raising the prospect of major refund claims.

But refund mechanics in trade law can be slow, technical, and litigation-heavy. Even the dissent highlighted that returning the money could become a “mess,” reflecting how complicated it may be to unwind past collections.

For businesses, this means a period of “accounting uncertainty”: companies may file claims, but outcomes could depend on future court battles, agency procedures, and the timing of any replacement tariffs.

Trump’s Backup Plan: A Temporary 10% Global Tariff Under a Rarely Used Law

Section 122 and the 150-day clock

Within hours of the Supreme Court ruling, Trump pivoted to Section 122 of the Trade Act of 1974 – a provision Reuters described as “never-used” for imposing duties broadly for a limited period.

The White House fact sheet states that Trump is invoking section 122 and that the proclamation imposes, “for a period of 150 days, a 10% ad valorem import duty.”

The proclamation itself explains that Section 122 authorizes a temporary import surcharge up to 15% for up to 150 days (unless Congress extends it), and sets the new surcharge at 10% on most imported articles.

Key takeaway: even after losing under IEEPA, the administration moved fast to keep a global baseline tariff in place – at least temporarily.

Also Read: India-US Mega Trade Breakthrough: US Cuts Tariffs on Indian Goods to 18%

When it starts, and when it ends

The White House proclamation sets the effective date at 12:01 a.m. ET on February 24, 2026, and indicates it will continue through July 24, 2026, unless changed or extended by Congress.

For global suppliers and buyers, those dates matter as much as the rate itself. A 10% duty can reshape pricing decisions quickly, especially in sectors with thin margins.

Exemptions: what’s in and what’s out

The White House fact sheet lists multiple categories exempted from the temporary duty – such as certain critical minerals, some agricultural products, pharmaceuticals, certain electronics, some vehicles and parts, aerospace products, informational materials, and more.

It also says the duty does not apply to:

- Articles subject to Section 232 actions

- USMCA-compliant goods from Canada and Mexico

- Certain CAFTA-DR duty-free textile and apparel goods

These exemptions are not a footnote – they determine which countries and sectors actually feel the 10% shock.

The Administration’s Broader Toolkit: Section 301 and Section 232

Why the U.S. Trade Representative’s statement matters

The U.S. Trade Representative (USTR) issued a statement emphasizing that the Supreme Court decision addressed only the constitutionality of Trump’s “Reciprocal and Fentanyl Tariffs” under IEEPA – and that many tariffs under other laws remain in place.

USTR specifically noted that:

- Existing Section 301 tariffs on China range from 7.5% to 100% (product-dependent)

- Existing Section 232 sectoral tariffs range from 10% to 50%

That’s a crucial signal to markets: even if IEEPA tariffs fall, U.S. tariff pressure doesn’t disappear. It changes legal shape.

Why Trump is launching new investigations now

Reuters reported that Trump also ordered new investigations under Section 301 (unfair trade practices) and leaned on Section 232 (national security) possibilities – methods that tend to be slower but more procedurally established than IEEPA.

In simple terms, the 150-day Section 122 tariff functions like a bridge:

- Keep tariff leverage alive now

- Use the window to build longer-term, more legally durable tariffs through other statutes

Why This Is Trending Globally: A Major Check on Presidential Power

The constitutional line: who gets to tax

This ruling is trending because it’s not only about trade – it’s about governance. The Court’s view is that tariff power is fundamentally tied to Congress’s taxing authority, and cannot be assumed through vague emergency language.

For investors, multinational firms, and foreign governments, that constitutional clarity has value: it can reduce the risk that tariff regimes change overnight based on an “emergency” declaration alone.

But uncertainty remains – because replacement powers exist

At the same time, the dissent and the administration both point to other routes – Section 122, 301, 232 – that can still produce high tariffs.

So the world isn’t moving from “tariffs” to “free trade.” It’s moving from one fast legal trigger (IEEPA) to a cluster of alternative triggers, some fast (Section 122), others slower (301/232), each with different constraints.

What It Means for India: Relief, Repricing, and Renegotiation

Why India is watching this ruling so closely

India’s exposure to U.S. tariffs isn’t theoretical. A Press Information Bureau (PIB) release describing U.S.–India trade understandings notes that the U.S. would apply a reciprocal tariff rate of 18% under an executive order framework on originating goods of India in multiple sectors, while also outlining possible removals or adjustments for certain product categories as trade talks progress.

That context matters because it shows how tariff policy has been intertwined with broader trade negotiation structures – and why any legal disruption in U.S. tariff authority can change bargaining dynamics.

Sectors likely to feel immediate pricing pressure

Even a “temporary” 10% global tariff can hit Indian exporters and U.S. importers who source from India, particularly where contracts are priced tightly or where India competes with duty-free or lower-duty alternatives.

Sectors that often feel tariff sensitivity include:

- Textiles and apparel

- Leather and footwear

- Engineering goods and certain machinery

- Chemicals and home décor categories (as noted in the PIB summary of sector coverage)

Because the White House fact sheet includes exemptions for certain categories (like some pharmaceuticals and certain electronics), the sector-by-sector hit will depend on classification and whether goods fall into exempt lists.

What Indian exporters and MSMEs should do now

If you’re an exporter or a sourcing professional dealing with U.S. buyers, the next 2–6 weeks are about discipline and documentation:

- Confirm HTS classification and exemption status

A 10% duty on paper can become “0%” in practice if your product falls under exemptions. Your customs broker’s classification is now a strategic decision, not routine paperwork. - Renegotiate tariff clauses in contracts

Many contracts define who bears “new duties.” With tariffs changing legal basis quickly, clarifying pass-through mechanisms avoids disputes. - Plan for two scenarios at once

- Scenario A: Section 122 stays for the full 150 days and then lapses

- Scenario B: Section 301/232 actions replace it with country- or sector-specific duties

Reuters notes that Section 122 expires unless Congress extends it, making it inherently time-bounded.

- Track USTR investigations and country targeting

Reuters reported that USTR investigations under Section 301 may not immediately name targets but can quickly become country-focused.

For India, the best move is to treat this as a “tariff weather system”: the storm path can change, but you can still prepare.

What It Means for China: Tariffs Shift From Emergency to Enforcement Frameworks

China remains the core tariff focus, even without IEEPA

Even with IEEPA tariffs struck down, USTR states clearly that existing Section 301 tariffs on China (7.5% to 100%) remain, alongside sectoral Section 232 measures.

That means China’s tariff exposure is less about the death of one law and more about the continuity of a broader enforcement toolkit.

Why the legal pathway matters for global supply chains

For multinational supply chains, the legal basis affects predictability:

- IEEPA was fast and broad (now blocked for tariffs)

- Section 301 is slower but structured

- Section 232 is sector-oriented and national-security framed

- Section 122 is fast but time-limited (150 days unless extended)

So China-linked supply chains may face fewer surprise “emergency switches,” but not necessarily lower tariff levels over time.

A Constitutional Line in the Sand – and the “Major Questions” Undertone

The Court’s message to future presidents

The Supreme Court’s approach signals: if a president wants to do something economically massive – like sweeping global tariffs – Congress must speak clearly.

The opinion leans on the logic commonly associated with the “major questions” line of reasoning: ambiguous language is not enough for actions of “vast economic and political significance.”

Notably, reporting indicates the liberal justices did not join the part of the opinion tied to that doctrine, showing the Court’s reasoning has layers even within the majority.

Will Congress rewrite tariff authority?

The ruling may push Congress toward a political choice:

- Rein in executive tariff flexibility further

- Or create a clearer statutory framework that delegates tariff authority with limits

For now, the administration is acting as if it can keep tariff pressure alive without waiting for Congress – using Section 122 immediately and gesturing toward 301/232 investigations for longer-term moves.

When Trade Becomes a Test of Values

Trade wars often look like spreadsheets – percentages, exemptions, deadlines – but underneath are human impulses: fear, pride, and sometimes an endless race for “more.” In teachings shared by Sant Rampal Ji Maharaj, repeated social suffering is closely tied to unchecked greed and a loss of inner discipline, and that real stability comes when society moves toward righteousness, compassion, and self-restraint rather than exploitation.

One article from the official Jagat Guru Rampal Ji Maharaj platform describes how greed for material gain hollows peace in families and society, urging reform through right conduct and spiritual understanding. In the same spirit, Sat Gyaan encourages people to pursue truth-based living and devotion so decisions – personal or political – don’t become driven only by profit or power. For those seeking deeper context, Sant Rampal Ji Maharaj’s satsang resources are available through official channels.

Call to Action: Stay Ready for the Next Tariff Twist

If you import, export, study commerce, or run an MSME, treat this moment as a live case study in how law, policy, and markets collide. Save the key documents (Supreme Court opinion, White House fact sheet, USTR statement), confirm product classifications, and build a “tariff response plan” that includes contract clauses, pricing buffers, and alternate sourcing options.

Most importantly, follow the next 150 days closely: the temporary measure may expire, but new 301/232 actions could replace it.

FAQs on Supreme Court Blocks Trump’s Global Tariffs

Q1. What did the U.S. Supreme Court actually block?

It ruled that IEEPA does not authorize the President to impose tariffs, striking down tariffs imposed under that emergency-powers law.

Q2. Does this mean all Trump tariffs are gone?

No. USTR says tariffs imposed under other statutes – like Section 301 (China) and Section 232 (sectoral) – remain in place.

Q3. What is Trump’s “backup plan” tariff?

A temporary 10% import duty for 150 days under Section 122 of the Trade Act of 1974, effective February 24, 2026 (per the White House fact sheet and proclamation).

Q4. Will importers get refunds for tariffs already paid under IEEPA?

Refunds are possible but complicated. Reporting highlights major uncertainty over process and timing, with large sums potentially at stake.

Q5. Why is this ruling such a big deal beyond trade?

It’s a major separation-of-powers moment: the Court emphasized that tariff/tax power belongs to Congress and requires clear authorization.

Q6. How does this affect India–U.S. trade specifically?

India’s export sectors and ongoing tariff understandings are sensitive to U.S. tariff frameworks; sudden legal changes can alter negotiation leverage and near-term pricing.

Discussion (0)