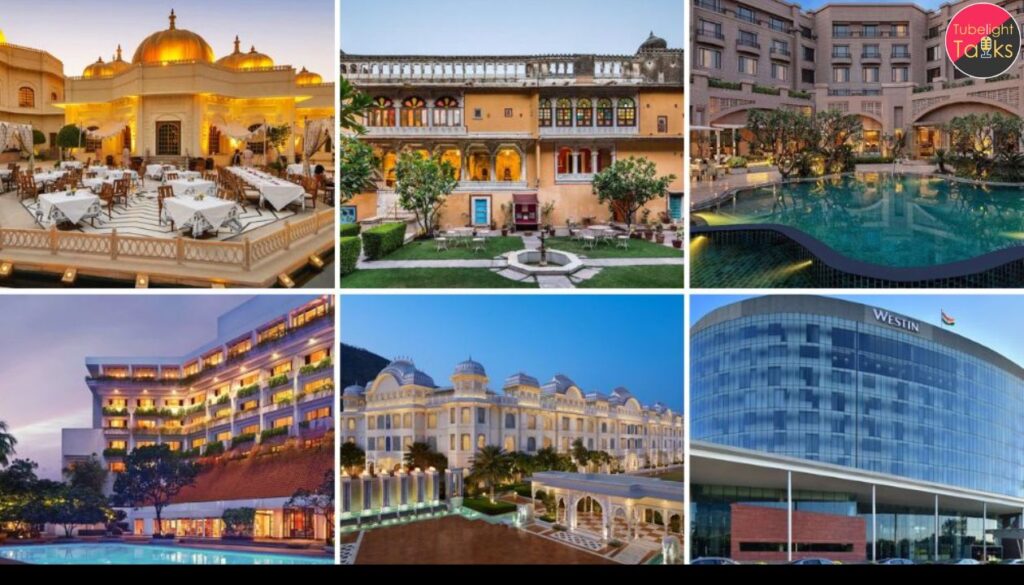

India’s Luxury Hotel Boom: 20,000+ New Rooms by 2030 as Foreign Investment Flows In

India’s luxury hotel boom and high‑end hospitality sector is entering a major growth phase. According to industry consultancy HVS Anarock, more than 20,300 new luxury hotel rooms are projected to be added in India by 2030. At the same time, leading Indian hotel groups are setting targets of 20,000+ keys (rooms) in their portfolios and foreign hotel brands are aggressively entering the market. This signals a strong vote of confidence in India’s domestic and luxury‑travel growth story.

Why the Boom? Key Drivers

Rising Travel Demand

- India’s domestic travel market has rebounded strongly. According to the World Travel & Tourism Council and other industry estimations: domestic spending reached new highs, international inbound tourism is recovering, and demand for luxury experiences is picking up.

- As the article in Business Today highlights, the opening of properties like the 327‑room Fairmont Udaipur Palace in Rajasthan signals how luxury travel is becoming more mainstream in India.

Supply Gap & Investment Opportunity

- India currently has only about 0.3 hotel rooms per 1,000 population, compared to global averages of around 2.2 rooms, reflecting massive headroom for expansion.

- Major Indian hospitality groups are responding: for example, ITC Hotels has set a goal of adding 20,000+ keys by 2030 across its luxury and upscale portfolio.

- Foreign hotel chains such as Hilton and Marriott are expanding rapidly in India’s Tier‑II and Tier‑III cities, attracted by the growth potential.

Infrastructure & Policy Support

- Connectivity improvements (airports, regional flights under the UDAN scheme, rail links), along with tourism‑promotion policies, are opening new luxury tourism destinations beyond metros.

- The luxury travel segment is enjoying rising disposable incomes, growing experience‑led consumption and a shift in lifestyle preferences.

Impacts & Implications

Economic & Employment

- The luxury hotel expansion will create jobs in construction, hospitality operations, F&B, travel services and allied sectors.

- Higher room revenue and premium tariffs will boost hotel‑industry profitability and drive real‑estate and service‑sector growth in hospitality hubs.

Regional Growth

- Growth is likely to spread to Tier‑II and Tier‑III cities, high‑potential destinations (heritage, scenic, spiritual tourism), reducing overload on major metros.

- Enhanced investment will bring luxury experiences to new regions, further raising India’s tourism competitiveness globally.

Investor & Brand Focus

- Hospitality‑asset investors and hotel chains will increasingly view India as a “must‑have” market in Asia.

- Brands will need to maintain service standards, differentiate offerings and innovate in luxury to capture discerning travelers.

Risks & Challenges

- Over‑building or mis‑judging demand could lead to supply gluts in some markets.

- Operational challenges include staffing skilled labour, maintaining luxury standards, and managing cost inflation (land, construction, wages).

- Sustainability and environmental concerns are increasing—luxury hotels must align with low‑carbon and responsible tourism imperatives.

Luxury With A Higher Purpose

According to the teachings of Sant Rampal Ji Maharaj, true luxury is not merely in external comfort, but in internal elevation—serving others, respecting all beings and living with gratitude. While India’s luxury‑hotel boom is an economic success, Maharaj Ji’s lessons remind us that hospitality should uplift communities, preserve nature and honour local heritage.

“When service flows from the heart, when every guest is treated as divine, then luxury becomes more than gold and marble—it becomes a sanctuary of the soul.”

Such a vision encourages hotel developers and operators to integrate sustainability, cultural authenticity and social responsibility into luxury experiences.

Call to Action: For Stakeholders in the Luxury Hospitality Boom

- Hotel Developers & Investors: Evaluate emerging destinations, adopt asset‑right models, invest in talent and training, integrate sustainability.

- Government & Tourism Bodies: Promote luxury tourism circuits, ensure infrastructure (air, roads, connectivity) supports high‑end hospitality, incentivise investment in non‑metro luxury lodging.

- Local Communities & Entrepreneurs: Leverage luxury‑tourism growth to offer authentic local experiences (crafts, heritage stays, cuisine), participate in hotel‑ecosystem value chains.

- Guests & Luxury Travelers: Choose hotels that reflect authenticity, responsible luxury practices and community benefit—not just opulence.

Read Also: 14 Dead In Kolkata Hotel Fire: 10-Hour Struggle Reveals Safety Shortcomings

FAQs: India’s Luxury Hotel Boom

Q1. How many new luxury hotel rooms are expected by 2030 in India?

More than 20,300 new luxury hotel rooms by 2030, per HVS Anarock.

Q2. Why is this boom happening now?

Because of rising domestic travel, increasing international arrivals, a significant room‑supply gap, foreign investment interest and improved infrastructure.

Q3. Which cities will benefit most?

While metros remain important, growth is accelerating in Tier‑II/III cities, heritage destinations, spiritual circuits and luxury resort zones.

Q4. What are the major risks?

Potential oversupply, staffing challenges, rising construction costs, maintaining luxury service quality and ensuring sustainable practices.

Q5. How does this relate to spirituality and social impact?

Luxury hospitality offers opportunity not just for profit, but for cultural preservation, sustainable tourism, community uplift and mindful service.

Discussion (0)