Digital Currency vs Cash Economy: Which Direction is India Headed?

Digital Currency vs Cash Economy: India’s financial transformation is at a historic turning point. While cities embrace UPI and the RBI’s Digital Rupee pilot, rural Bharat continues to rely on the familiar comfort of cash. As technology reshapes the economy, experts ask — is India truly ready to go fully digital, or will the future remain a mix of both worlds?

News Highlights:

- RBI’s Digital Rupee pilot marks a major step toward a cashless economy.

- UPI transactions cross ₹20 lakh crore per month in 2025.

- Rural India still depends heavily on cash-based transactions.

- Experts highlight issues of privacy, digital literacy, and inclusivity.

- India may become a “less-cash” economy, not fully cashless.

India is witnessing a financial evolution like never before. With UPI transactions setting new records and the Reserve Bank of India introducing its Central Bank Digital Currency (CBDC) — popularly known as the Digital Rupee — the nation is stepping into a bold new monetary era.

The Digital Rupee differs from cryptocurrencies such as Bitcoin because it is fully backed and regulated by the RBI. Its objective is to make transactions faster, safer, and more transparent while curbing the risks of counterfeit money and corruption.

However, experts caution that excessive reliance on digital money could raise privacy and data surveillance concerns. Many citizens still prefer cash, especially in rural and semi-urban regions where internet access remains limited. For millions of small traders, laborers, and farmers, cash means control and trust — something no app can replace.

Analysts believe India’s future lies in a balanced financial system, where both digital and cash transactions coexist. This “less-cash” model can ensure inclusivity while promoting innovation. The government’s focus, therefore, must remain on digital literacy, cybersecurity, and rural network expansion.

The Digital Transformation of India

In less than a decade, India has become the global leader in digital payments. From chai stalls to corporate houses, almost everyone now accepts UPI, Paytm, or PhonePe. According to recent RBI data, India recorded ₹20 lakh crore in UPI transactions per month in 2025 — a figure that showcases a nation transforming into a digital powerhouse.

FinTech startups, Aadhaar-linked payment systems, and government-backed initiatives like Digital India Mission have fueled this remarkable shift.

The Rise of India’s Digital Rupee (CBDC)

The Central Bank Digital Currency (CBDC), or Digital Rupee, launched by the RBI, is a government-backed virtual version of money.

Unlike cryptocurrencies, it is regulated, stable, and legal tender.

- The government’s aim:

- Simplify interbank transactions

- Reduce corruption and counterfeit currency

- Enhance transparency in the financial system

Yet, economists caution that total digital dependency could expose users to data surveillance and privacy risks.

Why Cash Still Holds Power

Despite digital dominance in cities, cash continues to be king in India’s rural and semi-urban regions. For millions, cash offers trust, tangibility, and simplicity.

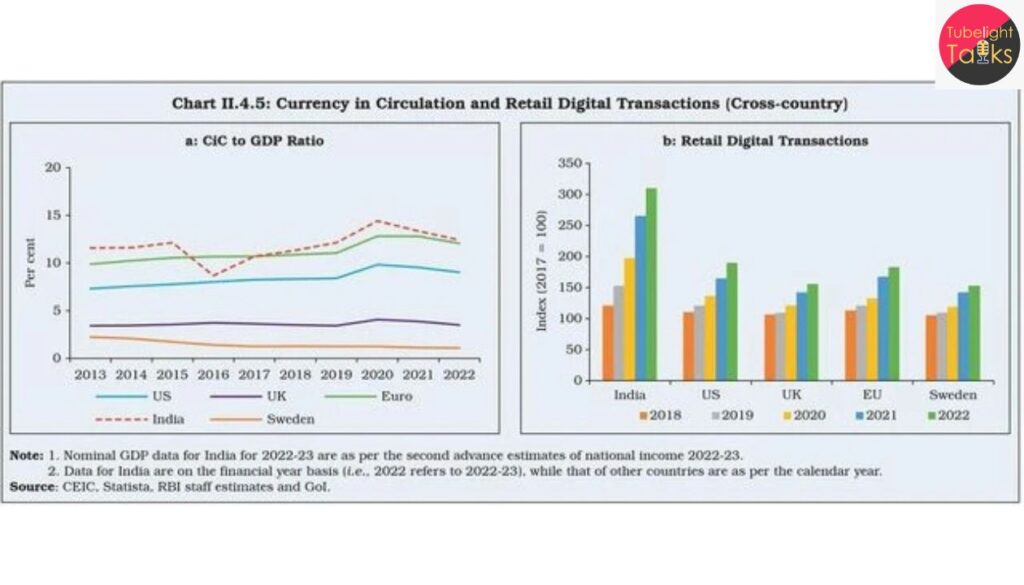

Farmers, daily wage workers, and small traders still prefer physical currency for quick, offline transactions. India’s informal economy, employing more than 80% of the workforce, remains largely cash-driven. So while digital payments rise, cash circulation hasn’t declined significantly — it’s just coexisting differently.

Finding the Balance: ‘Less-Cash’ Economy

Experts believe India is not heading for a cashless economy, but a less-cash one. Both systems will coexist — digital for convenience, cash for inclusivity.

The government’s real challenge lies in:

- Strengthening digital literacy

- Ensuring cybersecurity

- Extending internet access to every village

- Financial inclusion must remain at the heart of progress.

FAQs

Q1. What is the Digital Rupee (CBDC)?

A government-backed virtual currency issued by the Reserve Bank of India.

Q2. Is it similar to cryptocurrency?

No. Unlike private cryptocurrencies, it’s regulated and backed by the RBI.

Q3. Will cash disappear in India?

No. India is moving toward a “less-cash” economy, not entirely cashless.

Q4. What are the main concerns with digital currency?

Data privacy, cyber threats, and digital literacy gaps.

Q5. How will the Digital Rupee benefit common citizens?

It aims to make transactions faster, transparent, and more secure.

Discussion (0)