Global Innovation Index 2025: Innovation at a crossroads

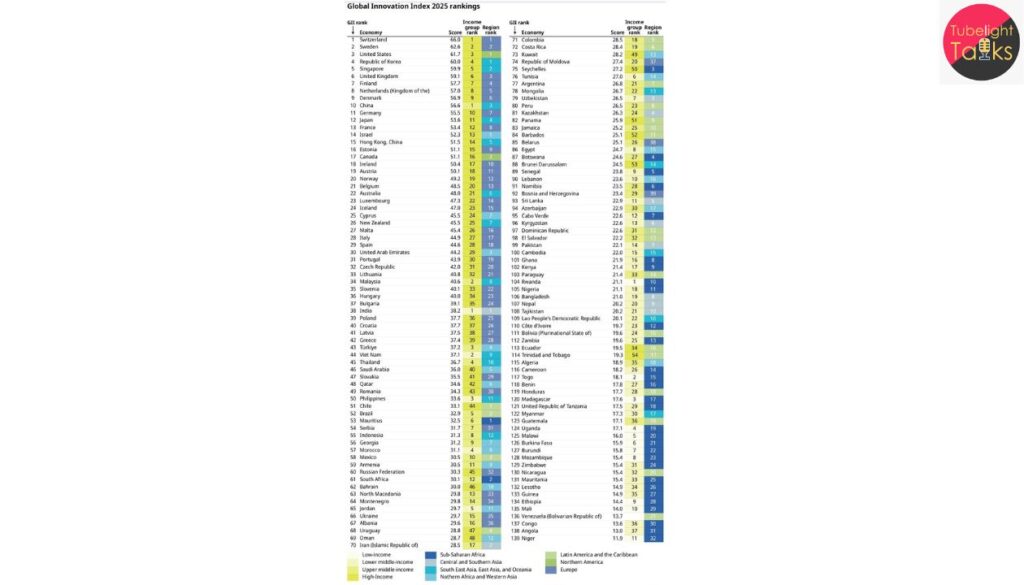

Global Innovation Index 2025 of the 18th edition, released by WIPO on 16 September 2025, presents a nuanced picture major gains for some economies, new entrants into the elite club, yet warning signs of decelerating investment in innovation globally. For example, Switzerland retains the number‑one spot, Sweden is second, and the United States third. Most notably, China has entered the top 10 for the very first time, rising to 10th place overall.

Yet while rankings show success stories, the report highlights that global growth in research & development (R&D) is slowing — from a 4.4 % rise in 2023 to just 2.9 % in 2024, with a projection of 2.3 % for 2025.

What are the headline findings of GII 2025?

Top economies and rankings

- Switzerland remains world‑leader for the 15th consecutive year.

- Sweden is 2nd, USA 3rd.

- China jumps into the top 10 (10th place) for the first time — the only middle‑income economy in that top tier.

- India is ranked 38th, improving its standing among middle‑income economies.

Innovation clusters redefine geography

The GII 2025 also ranks innovation clusters (cities/regions). For example, the Shenzhen‑Hong Kong‑Guangzhou cluster has overtaken Tokyo‑Yokohama to become the world’s top innovation cluster.

Investment & growth issues

Despite headline successes, several indicators are weakening: venture capital (VC) deal counts in many regions have stalled, growth of R&D spending has slowed, and technology adoption rates are less uniformly strong.

Innovation across regions

Several middle‑income economies (India, Türkiye, Viet Nam, Morocco) are climbing fastest. Meanwhile, emerging clusters in Africa and Latin America are showing early signs of strengthening.

Why does this matter?

For economies & competitiveness

Being high on the Innovation Index confers strategic advantage. Countries with stronger innovation capacity are better positioned for future growth, higher productivity, stronger global companies, and resilience in a shifting global order.

For investment & technology flows

Innovation capacity determines how a country attracts investment in high‑tech sectors, how it participates in global value chains, and how it exports high‑value goods and services. China’s leap to top 10 reflects its growing role in AI, semiconductors and green technologies.

For policy‑makers & development

Slowing global R&D growth suggests that countries need to rethink how they fund innovation, build ecosystems, and translate research into impact. The GII report acts as a diagnostic tool and a policy compass.

China’s rise – a game‑changer

Key drivers

China leads globally in knowledge & technology outputs. It hosts more top‑100 innovation clusters (24) than any other country. Its investment in high‑tech exports (AI, EVs, semiconductors) is accelerating.

Implications

China’s entering the top 10 signals a paradigm shift: innovation leadership is no longer confined to advanced OECD economies alone. Emerging economies can leap ahead with the right mix of policy, investment and clusters.

Challenges ahead

Despite strong output, China still lags in institutional indicators (such as independence, transparency) relative to its peers. Sustaining momentum will require deeper structural reforms.

Also Read: China Breaks into Global Innovation Top 10 in 2025

India’s position – strengths and gaps

Where India excels

India’s ranking of 38th puts it among the fastest climbers in the GII ranking. It performs especially well in Knowledge & Technology Outputs (ranked 22nd) and shows strong performance in market sophistication and investment into startups/unicorns.

Where India must improve

However, India’s ranking remains weaker in business sophistication (64th), infrastructure (61st) and institutions (58th).

What India should focus on

- Strengthen institutions and governance for innovation.

- Boost infrastructure (digital, transport, power) which is foundational for innovation.

- Foster business‑R&D collaborations and improve business sophistication.

- Enhance global competitiveness of Indian tech exports and clusters.

Innovation growth slow‑down – what’s behind it?

R&D growth cooling

Global R&D growth slowed from previous highs to 2.9 % in 2024 and is projected around 2.3 % in 2025 — the lowest since 2010.

VC deal activity concentrated

While overall VC value rose modestly (+7.7 % in 2024), much of the growth was due to mega‑deals in U.S.‑AI segments. Excluding those, VC flows have contracted and geographic spread is narrowing.

Technology adoption plateauing

Although AI, quantum computing and green tech keep advancing, the rate of adoption of robotics, EVs and communication infrastructure is uneven — especially across regions.

Socio‑economic translation

Innovation inputs aren’t always turning into broad socio‑economic benefit. The GII emphasises measuring not just outputs (patents, exports) but also adoption, impact and equity.

The key levers to lift innovation performance

Policy & institutional reform

- Create stronger links between research institutions, industry and government.

- Enhance intellectual property frameworks, encourage commercialization.

- Foster open innovation ecosystems and support startup culture.

Regional & cluster‑development focus

Innovation increasingly happens in clusters — cities and regions where talent, resources, capital and institutions converge. The rise of the Shenzhen‑Hong Kong‑Guangzhou cluster underscores this.

Diversified investment & infrastructure

Investing in infrastructure (digital networks, labs, transport), human capital, and maintaining diversified investment portfolios (not just AI/ICT) will help cushion innovation from shocks.

Equity, inclusion & impact

Ensuring that innovation benefits aren’t concentrated only in a few locations/sectors is important. The GII flags rising inequality and uneven spill‑over as risks.

Purpose-driven Progress And Shared Welfare

While the world focuses on metrics such as patents, clusters and exports, the teachings of Sant Rampal Ji Maharaj remind us that real innovation transcends technology alone – it is concerned with upliftment of human life, purpose‑driven progress and shared welfare.

In this context, innovation must not only create new products or services, but also enhance human dignity, reduce suffering and promote collective well‑being. As countries race up innovation rankings, aligning progress with responsibility and purpose becomes not just desirable—but essential. When a region boosts venture capital or patents but neglects social impact or inclusive growth, the innovation may be hollow. The GII’s own concern about “adoption” and “impact” bridges this gap.

What to Watch Next — The Outlook

Indicators to follow

- Private‑sector R&D growth and late‑stage VC flows.

- Innovation investment in emerging technologies (AI, quantum, biotech, green tech).

- Performance of innovation clusters outside traditional hubs (Africa, Latin America).

- Translation of innovation into socioeconomic outcomes: higher productivity, jobs, inclusive growth.

Potential Scenarios

- If investment declines further, global innovation growth could stall below 2 % annually—a scenario with implications for future productivity and growth.

- Emerging economies that keep climbing (India, Viet Nam, Morocco) may challenge the current innovation hierarchy.

- Disruptions in global supply chains, trade‑war escalations or ESG (environment, social, governance) pressures could reshape where innovation happens.

Action‑points for stakeholders

- Governments need to articulate clear innovation strategies with measurable targets.

- Businesses must invest in both core R&D and ecosystem‑building (clusters, start‑ups, partnerships).

- Academia and research institutions must enhance translational capacity and industry linkages.

- Citizens and civil society must engage with the question: does innovation serve people as much as it serves profits?

Innovation is no longer a luxury—it is a necessity. The Global Innovation Index 2025 shows that the landscape is changing: new players are rising, structural headwinds are growing, and the definition of success is evolving. For nations, businesses and society at large, the challenge is to turn innovation potential into real value—for all.

FAQs: Global Innovation Index 2025

Q1. What is the Global Innovation Index (GII)?

The GII is an annual ranking by WIPO that assesses countries’ innovation performance based on 80+ indicators including R&D, technology, education, and business capabilities.

Q2. Which country topped the GII 2025?

Switzerland retained the top spot for the 15th consecutive year, followed by Sweden and the United States.

Q3. Why is China’s entry into the top 10 significant?

It marks the first time a middle-income country has reached the elite innovation club, reflecting China’s massive investment in high-tech sectors like AI, semiconductors, and green tech.

Q4. How did India perform in the GII 2025?

India ranked 38th overall, showing strong performance in knowledge & tech outputs, but weaker in infrastructure and business sophistication.

Q5. What concerns were raised in the 2025 report?

Global R&D growth is slowing, VC funding is concentrated in select sectors/countries, and tech adoption is uneven — raising alarms about long-term innovation sustainability.

Discussion (0)