IMF Raises Global Growth to 3.2% but Holds Warning Flags

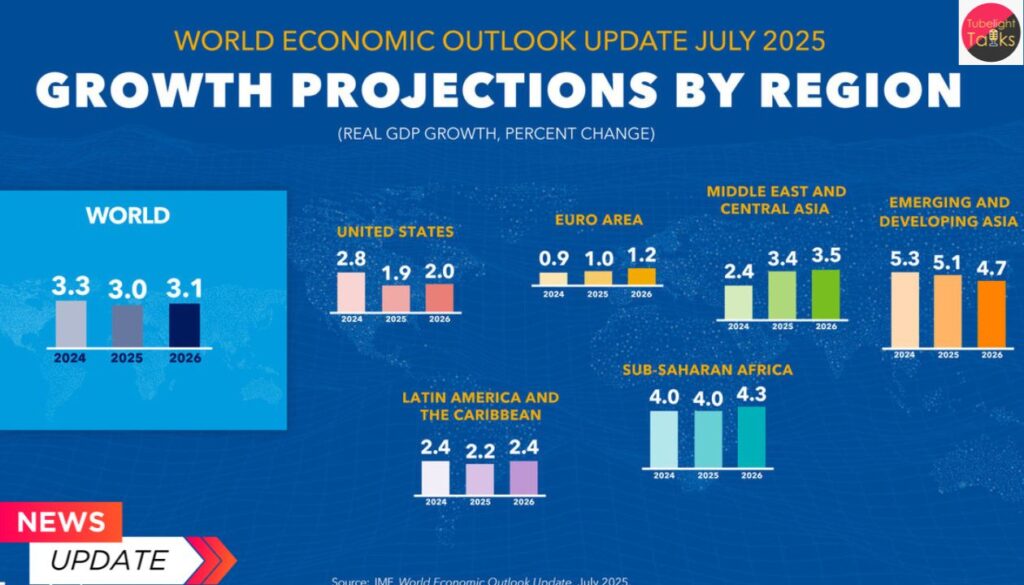

IMF Raises Global Growth: The IMF published its World Economic Outlook in October 2025, raising the projected global real GDP growth for 2025 to 3.2 %, up from the 3.0 % forecast in July. Growth for 2026 is projected at 3.1 %, a modest slippage from 2024’s 3.3 %. Despite the uptick, the IMF emphasises that the recovery is fragile, and structural headwinds persist. “Stay cautious,” IMF Managing Director Kristalina Georgieva said, adding that “uncertainty is the new normal.”

What’s Changing and What’s Staying the Same

Better than feared, but not enough

The upward revision was driven by slightly improved conditions in trade, resilient investment and the fact that some shocks (such as tariffs) haven’t fully unfolded yet.

Yet, the pace remains below what many consider healthy for global economic dynamism.

Regional outlooks diverge

Advanced economies are expected to grow about 1.6 % in 2025, emerging markets roughly 4.2 %. The U.S. is forecasted at 2.0 % for 2025 and 2.1 % for 2026, helped by investment in new technologies such as AI. China’s growth is projected to moderate to around 4.8 % in 2025, down from higher levels in prior years.

Key Risks and Structural Challenges

Trade tensions, fragmentation & supply‑chain shifts

The IMF warns that further escalation in trade conflicts—especially between the U.S. and China—could derail the recovery. Firms have so far mitigated impact via front‑loaded trade and rerouted supply chains, but those buffers may fade.

Rising global debt

Another major concern is public debt. The IMF notes that global government debt may reach 100 % of global GDP by 2029—raising stability risks.

Technology, investment and uneven recovery

While technology investment (particularly AI) has helped cushion the impact in some countries, the benefits are not evenly distributed. This raises concerns of inequality, productivity gaps and instability in the medium term.

Implications for Policy and Business

For policymakers

The IMF emphasises that today’s policy decisions on trade, investment, climate and technology will shape growth for years. Governments are urged to strengthen fiscal buffers, manage debt, support innovation, and maintain open trade architectures.

For businesses and investors

In a slower‑growth world, companies face a tougher environment. Efficiency, diversification, and future‑proofing (e.g., green tech, digital transformation) become more critical. Stakeholders should prepare for volatility, not just steady growth.

Why This Matters for India and the World

India was singled out by the IMF as one of the fastest‑growing major economies, with growth projections around 6 %+. For global stability, large emerging economies like India play a vital role in sustaining aggregate demand, investment and structural adjustment.

For developed economies, the slower growth outlook means they must rely more on productivity gains, innovation and structural reform—rather than external tailwinds. The combination of slower trend growth, high debt, and elevated risk means the “new normal” for the world economy is one of moderate growth with major vulnerability.

also Read: IMF Upgrades India Growth 2025-26 Outlook Amid Global Economic Challenges

Human Welfare Ethical Growth Not GDP

In an age of numbers, forecasts and global indicators, it may feel purely technical. Yet the teachings of Sant Rampal Ji Maharaj offer a deeper reminder: progress is not only measured by GDP but by human welfare, ethical growth and shared upliftment. As the IMF signals moderation and caution, societies are reminded that true prosperity lies not just in economic expansion—but in sustainable, inclusive, and value‑driven growth.

Looking Ahead — What to Watch

Economic triggers

Watch how trade policy evolves (especially U.S.–China), how AI and green investments scale, how debt is managed and how fiscal space is protected.

Time horizons and scenarios

The IMF warns that the downside risk remains stronger than the upside. A severe shock could push global growth below 2 %—something that firms and governments must prepare for.

Path to durability

For growth to become durable rather than transitory, the emphasis must shift from stimulus to structural reform, from quantity to quality, and from speed to sustainability.

FAQs: IMF Global Outlook October 2025

Q1. What are the new global growth forecasts for 2025 and 2026?

The IMF projects 3.2 % growth in 2025 and 3.1 % in 2026.

Q2. Why are forecasts being upgraded slightly?

Despite risks, some trade disruptions were less severe than expected, and investment remained resilient—leading to a modest adjustment upward.

Q3. What are the major risks?

Key risks include a resurgence of trade wars, ballooning global debt, uneven recovery, climate shocks and technology disruption.

Q4. What about emerging markets versus advanced economies?

Emerging markets are expected to grow around 4.2 % in 2025, while advanced economies are much slower at about 1.6 %.

Q5. How should businesses and policymakers respond?

They should focus on structural resilience—diversified supply chains, fiscal sustainability, innovation investment and inclusive growth models.

Discussion (0)