Investors adopt dot‑com era playbook amid AI boom to manage bubble risks

Investors adopt dot com era: The hype surrounding artificial‑intelligence (AI) has driven tech‑stocks and investors into hyper‑drive. Companies like Nvidia, Microsoft, Alphabet and Amazon are at the forefront of this surge. According to a Reuters commentary, some investors believe the AI‑boom market may still be at its “base camp” rather than the peak. In this environment, investors are recalling the lessons from the late‑1990s internet boom and the subsequent crash. As one asset‑manager put it: “What we are doing is what worked from 1998 to 2000.”

The Investors Playbook for 2025

Recognising the Signs of Exuberance

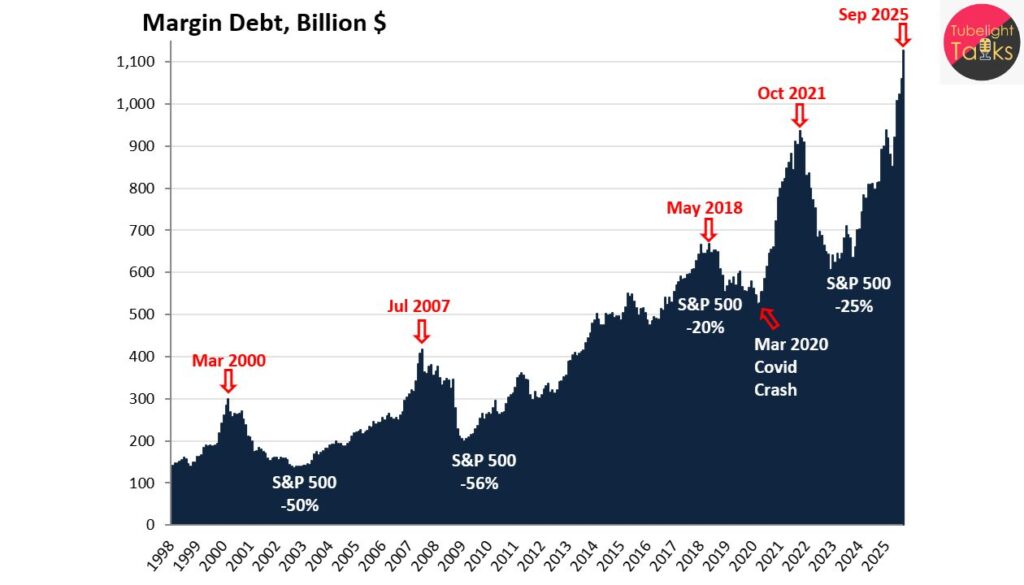

Analysts point to several signals reminiscent of the dot‑com era: soaring valuations, intensely concentrated equities, speculative options plays and infrastructure build‑outs (e.g., data‑centres) driven by AI‑hype. For example, at its peak the dot‑com bubble’s median P/E for top tech stocks exceeded 100x — by contrast, today’s “Magnificent Seven” have P/Es around 70x on average.

Rotation Strategy: From Hype to Adjacent Plays

Instead of “all‑in” on head‑liner tech firms, many investors are rotating into:

- Software and enterprise IT firms set to benefit from AI adoption

- Robotics, automation and Asian tech hardware/supply‑chains

- Infrastructure plays such as nuclear power (for AI data‑centres) or networking hardware

This playbook echoes hedge‑fund moves during the dot‑com era: exit fast, and redeploy into less‑crowded ideas.

Timing and Risk Management

The challenge is not predicting the peak of a bubble but managing exposure and liquidity prior to any overheat. As one strategist noted: “We’re in 1999 until the bubble pops.”

Broader Implications for Markets and Economy

Market Sentiment and Concentration Risk

With tech stocks constituting roughly 38% of the S&P 500 and a handful of companies dominating growth, market concentration is unusually high. If expectations falter, a swift re‑rating could trigger broader market stress.

Real‑Economy Spill‑Overs

If an AI investment bubble bursts, the impact may not be confined to the stock market. Warnings from the IMF suggest potential real‑economy repercussions—especially for jobs, capital‑goods sectors and innovation pipelines.

Innovation vs. Speculation

While AI holds transformative potential, many companies receiving huge valuations still lack strong earnings or business models. The gap between potential and realised performance is a risk.

Read Also: AI Boom in India 2025: How It’s Revolutionizing Smartphones, Jobs, and Daily Life

Tech Hype and True Progress

In this era of relentless technology fascination, the teachings of Sant Rampal Ji Maharaj—reflecting the principles of satgyan (true knowledge)—offer a guiding perspective: innovation is meaningful only when grounded in service, truth and upliftment of humanity.

The current AI‑phenomenon may generate stunning returns and excitement, but if it becomes merely a speculative frenzy devoid of ethical purpose, balanced growth and social value, it risks being a distraction rather than progress. As investors rotate into adjacent sectors and hedge against over‑exuberance, the deeper question remains: Are we using AI for genuine human advancement — or are we building castles in air?

Outlook – What to Watch

Valuation Trends and Sector Rotation

Will the “new winners” beyond the headline tech names emerge? Are valuations starting to diverge from fundamentals?

Capital Expenditure vs. Revenue Growth

Is the massive AI infrastructure spending translating into sustained business results and profitability?

Policy and Regulation Response

How will regulators respond to concentration risk, data‑centre expansion pressures and potential systemic vulnerabilities?

Innovation Ecosystem Health

Will the broader innovation ecosystem (start‑ups, talent, global supply‑chains) support real‑world deployments — or will hype dominate?

FAQs: Investors & AI Bubble Risk

Q1. What is the main concern about the current AI boom?

The concern is that valuations and investment momentum may outpace real‑world business performance, creating an AI‐investment bubble similar to the late‑1990s dot‑com crash.

Q2. What strategies are investors using to manage this risk?

They are rotating out of over‑valued tech firms and investing in adjacent sectors (software, robotics, Asian tech hardware) that may benefit from AI growth without being part of the hype.

Q3. Are we already at the peak of the AI bubble?

No — many analysts believe we are still in the build‑up phase (“base camp”), so risk of over‑valuation remains elevated.

Q4. How could an AI bubble affect the real economy?

If the bubble bursts, there could be job losses, stranded investment, reduced innovation momentum and broader market disruption beyond tech stocks.

Q5. What investment themes might succeed if the hype fades?

Investments in AI‑enabling infrastructure (data centres, chips), robotics, enterprise IT adoption, Asian supply‑chains, and sustainable tech could outperform as the hype phase recedes.

Discussion (0)