UPI Goes Global: Malaysia Acceptance, PayPal World Link, and NRI UPI on Foreign SIMs—A 2025 Explainer with Official Sources

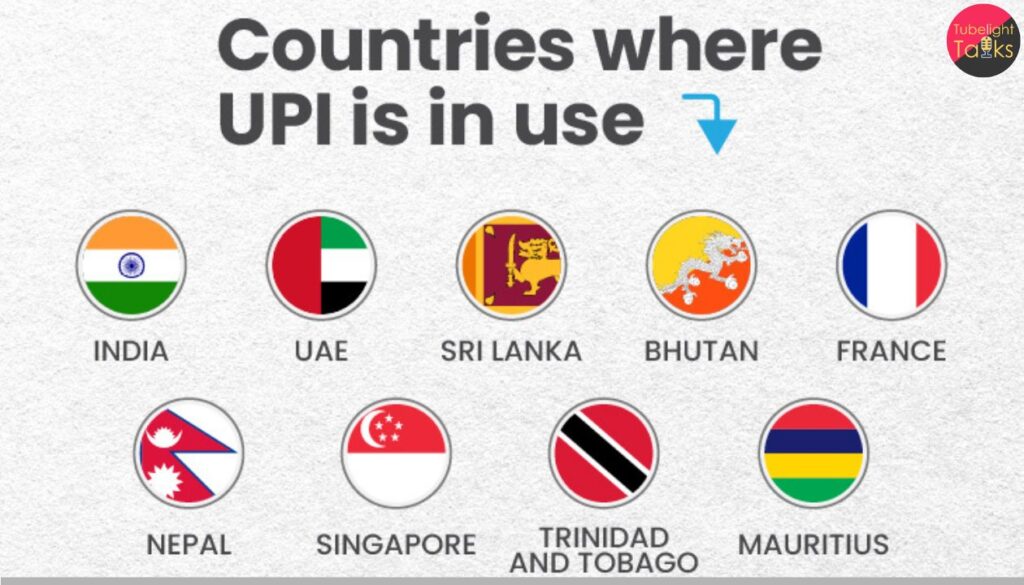

UPI Goes Global: India’s Unified Payments Interface (UPI) has moved decisively beyond home turf in 2025. The headline: UPI is being accepted in Malaysia through NIPL–Razorpay Curlec, joining a growing club of destinations (France, Singapore, UAE, Mauritius, Sri Lanka, Qatar, and more). In parallel, PayPal World announced an upcoming link to UPI, while NRIs can now use UPI on foreign SIMs—through NRE/NRO accounts—across a widening list of countries.

This in-depth explainer brings together what’s official, what’s live, and what’s next: acceptance points, bank readiness, fees/limits, remittance corridors (UPI–PayNow), and practical checklists for travelers and NRIs, with PIB/RBI/MAS/NPCI citations.

What’s new in late-2025: three big moves

1) UPI acceptance arrives in Malaysia

India’s international arm NIPL has partnered with Razorpay Curlec to enable UPI payments at Malaysian merchants. For Indian travelers, this means you can scan and pay with your existing UPI app; the merchant receives settlement in MYR, while your Indian bank debits INR at an indicative rate shown in-app. Multiple partner notes and mainstream coverage confirm the rollout, signed at Global Fintech Fest 2025.

The collaboration lets Indian visitors pay Malaysian merchants with their preferred UPI apps, with instant MYR settlement via Razorpay Curlec.

Malaysia now joins a broader map of UPI destinations where acceptance has been launched in stages: France (starting with the Eiffel Tower and expanding to Galeries Lafayette), Singapore via UPI–PayNow, and UAE at networks such as NeoPay/Network International/Magnati.

2) PayPal World to link with UPI

PayPal announced PayPal World, a cross-border payments platform that will link to local rails including UPI, broadening acceptance and wallet interop. The plan places UPI on a global stage alongside other major systems and wallets; NPCI is a named partner. (Rollout is staged through 2025 and beyond.)

3) NRI UPI with foreign mobile numbers (no Indian SIM needed)

NRIs can now access UPI using their international mobile numbers linked to NRE/NRO accounts, a facility introduced by NPCI in 2023 and expanded by banks through 2024–25. For example, IDFC FIRST Bank enables foreign SIMs from 12 countries (Australia, Canada, France, Hong Kong, Malaysia, Oman, Qatar, Saudi Arabia, Singapore, UAE, UK, USA). Official parliamentary and ministerial replies also document the policy.

Government clarifications note UPI access for NRIs with international numbers tied to NRE/NRO accounts; initially a defined country set, now expanding via participating banks.

Where can Indians pay via UPI overseas—today

Live examples and official anchors

- France: UPI accepted at the Eiffel Tower (first European merchant), now also at Galeries Lafayette (Haussmann, Paris)—via NIPL partnerships.

- Singapore: UPI–PayNow real-time remittance corridor launched by RBI & MAS in Feb 2023; expanded in 2025 to more Indian banks.

- UAE: UPI acceptance growing across NeoPay (Mashreq), Network International, Magnati merchant networks (retail, travel, hospitality).

- Sri Lanka & Mauritius: Joint UPI launch by leaders on Feb 12, 2024—UPI live; RuPay launched in Mauritius.

- Qatar: Acceptance rolling out via QNB for QR-based UPI at merchant PoS.

- Malaysia: Acceptance through Razorpay Curlec–NIPL announced; roll-out to Malaysian merchants for Indian travelers.

Tip for editors: When citing country coverage, prioritize official press releases (PIB, MAS, central bank, embassy or the partner’s newsroom) and then add reputable media confirmations.

How UPI works abroad: the plumbing you don’t see

Scan, authorize, settle—who does what

- You scan a partner QR (e.g., DuitNow QR in Malaysia via acquirers connected to NIPL partners).

- Your UPI app shows the amount, a conversion rate or indicative INR amount.

- You authorize (PIN/biometrics).

- The overseas acquirer settles in local currency to the merchant; your Indian bank debits INR.

This model mirrors UPI’s domestic flow, with extra FX and cross-border settlement pieces handled between NIPL and local partners.

Fees, rates, and disclosures

- FX spread is embedded or quoted; many pilots show the rate upfront before authorization.

- Merchant fees abroad depend on the local acquirer’s arrangement; in the UAE and France, press notes highlight standard local acquiring economics rather than card-scheme MDRs. (Always check local signage or app screens.)

Limits and compliance

UPI still observes RBI safety norms (txn caps, 2FA). For remittances (e.g., UPI–PayNow), corridor-specific limits apply; MAS/RBI materials describe per-tx/day caps and participating banks.

NRI UPI on foreign SIMs: who’s eligible and how to switch on

The rule

NPCI permitted onboarding of international mobile numbers for NRE/NRO accounts (initially a fixed list of countries). The policy surfaced via official clarifications and circulars in Jan 2023, later echoed in ministerial replies and banks’ feature rollouts.

The practice (2024–25 bank rollouts)

- IDFC FIRST Bank: free UPI on international numbers (12 countries list).

- Other banks: ICICI and peers published help pages on activating UPI with international numbers via their apps (availability varies by country).

What you need:

- An NRE/NRO account at a participating bank.

- Your foreign mobile number registered with that account.

- Supported UPI app and KYC in order.

- Expect cooling-off and risk rules on first-time setup.

Country snapshots: what’s live, what’s linking, what’s next

France (live tourist acceptance)

UPI launched at the Eiffel Tower and later Galeries Lafayette in Paris. The acceptance is expanding beyond flagships to retail and tourism spots as acquirers plug in UPI rails.

Singapore (live remittances)

UPI–PayNow is a bank-to-bank corridor for residents of India/Singapore—ideal for cross-border family transfers, not just point-of-sale. In July 2025, NPCI expanded participating Indian banks (total now 19), deepening access.

UAE (merchant acceptance scaling)

With NeoPay (Mashreq), Network International, and Magnati on board, UPI acceptance is spreading to malls, supermarkets and travel retail. Indian tourists pay from UPI apps; merchants receive AED.

Sri Lanka & Mauritius (government-to-government launch)

UPI was jointly inaugurated by leaders on Feb 12, 2024; RuPay also rolled out in Mauritius. This is a cornerstone of India’s Neighbourhood First agenda for digital public infrastructure.

Malaysia (new in 2025)

Via Razorpay Curlec–NIPL, Malaysian merchants will accept UPI from Indian travelers with real-time MYR settlement—no international card required.

Qatar (new acceptance ramp)

QNB is enabling QR-based UPI acceptance at its acquired merchants, adding the Gulf to the expanding acceptance map.

What this means for travelers, NRIs and MSMEs

Travelers

- Scan & pay abroad with your UPI app where the acceptance mark is present.

- Check rates before authorizing; keep international SMS/roaming ready for alerts.

- Carry backup: a card/wallet, in case a particular store isn’t live yet.

NRIs on foreign SIMs

- Link your foreign number to your NRE/NRO account and register on a UPI app supported by your bank.

- Expect first-use cooldowns and enhanced checks—standard anti-fraud design.

MSMEs in tourist hubs (India & overseas)

- In India, ensure UPI QR is visible for inbound tourists; for overseas merchants, watch for NIPL-acquirer integrations in your market to tap Indian footfall (France, UAE, Malaysia).

Technology with Fairness

Digital rails like UPI can reduce costs and remove friction, but they work best when users, banks, and merchants act with honesty and responsibility—transparent pricing, timely refunds, and fair treatment of customers and staff. Spiritual leader Sant Rampal Ji Maharaj guidance widely available online emphasizes truthful conduct and ethical work—employers to be considerate, employees to be diligent.

That values-first mindset improves trust in payments and commerce, especially across borders. For readers who want this perspective, see discourses on ideal behaviour for employers and employees and explore the book “Way of Living,” which frames prosperity and technology within a compass of righteous conduct.

Make UPI Your Default Abroad

Enable, test, and travel

- Before you fly: ensure your UPI app is updated; confirm international number mapping (NRIs) or keep your Indian SIM active (travelers).

- At destination: look for partner QR acceptance (France/UAE/Malaysia/Singapore). If unsure, ask the cashier for UPI via QR.

- For remittances: where appropriate, use UPI–PayNow for India–Singapore corridors—faster and often cheaper than legacy options.

- Stay safe: verify amounts and rate disclosures before authorizing; keep transaction alerts on.

- Merchants: if you cater to Indian customers, speak to your acquirer about adding UPI acceptance—footfall and conversion gains can be material.

Also Read: Digital Currency vs Cash Economy: Which Direction is India Headed?

FAQs: UPI Becomes Global

Q1. Is UPI actually live in Malaysia now?

Yes. NIPL has partnered with Razorpay Curlec to enable UPI acceptance at Malaysian merchants; rollout began after Global Fintech Fest 2025 announcements.

Q2. Can I use UPI in France and the UAE?

Yes. In France, UPI began at the Eiffel Tower and expanded to Galeries Lafayette; in the UAE, acceptance is scaling via NeoPay/Network International/Magnati networks.

Q3. What is UPI–PayNow—and is it only for tourists?

It is a real-time remittance link between India and Singapore for residents sending money between the two countries. It’s not a PoS scheme; it complements tourist acceptance elsewhere.

Q4. I’m an NRI. How do I use UPI on my foreign number?

Open/hold an NRE/NRO account at a bank that supports international number onboarding (country list varies); register your foreign number on the UPI app; follow KYC and cooling-off rules.

Q5. What is PayPal World’s connection to UPI?

PayPal World is a cross-border platform that will link PayPal with local payment rails, including UPI, expanding interop for shopping and remittances as it rolls out.

Q6. Are there fees when I pay via UPI abroad?

UPI itself is account-to-account, but FX and local acquiring fees/spreads may apply overseas. Apps typically show the rate before you authorize. Check your bank/app disclosure.

Q7. Which Indian banks are live for UPI–PayNow?

19 Indian banks are now enabled after NPCI expanded coverage in July 2025; check your bank’s status on the NPCI update.

Discussion (0)