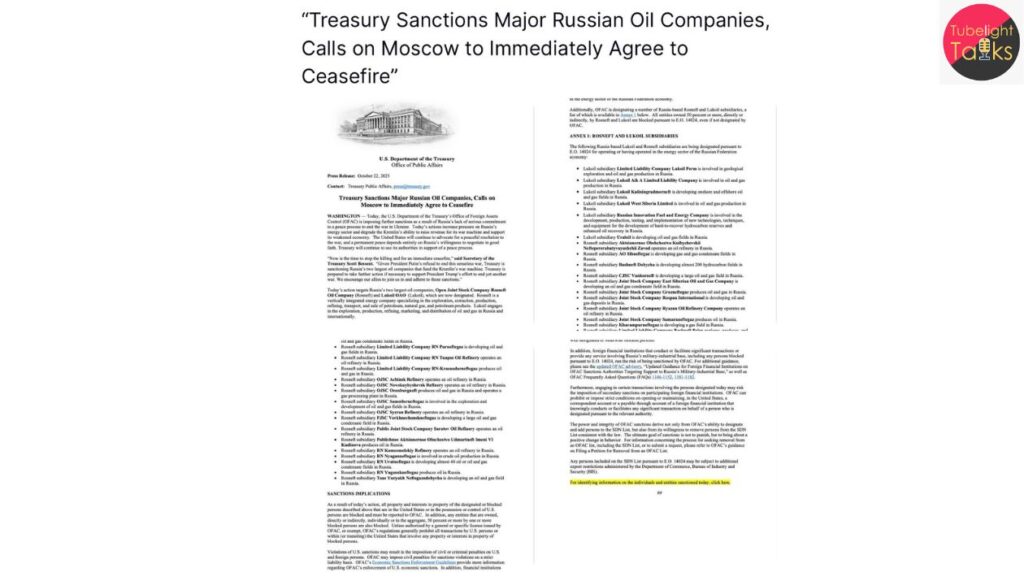

US Sanctions on Russian Oil Giants Mark a Turning Point in Energy and Geopolitics

US Sanctions on Russian Oil: Today’s announcement by the U.S. Department of the Treasury and the White House targets two of Russia’s most powerful oil companies—Rosneft and Lukoil—in what analysts are calling a major escalation of economic warfare tied to the ongoing conflict in Ukraine.

What the Sanctions Cover

Targets and measures

The sanctions impose blocking status on Rosneft and Lukoil, restricting dollar‑based transactions and prohibiting dealings with US persons and entities. In addition, the Treasury singled out subsidiaries, affiliates and tankers linked to the companies. The aim: to constrict Russia’s oil export earnings which feed the Kremlin’s fiscal and military machine.

Timing and intent

The timing is critical. The sanctions come amid mounting frustration in Washington that diplomacy with Moscow has stalled and that Russia’s war effort remains robust. As the White House put it, the move is intended to force a recalibration of Moscow’s strategy.

Immediate Market Reaction

Oil markets responded quickly. On announcement day, Brent crude futures jumped by nearly 5%, reflecting concerns that Russian supply disruptions may materialize. Many traders pointed to the sanctions as shifting the balance between supply risk and demand strength—a re‑opening of the premium on “geopolitical risk” in energy markets.

Broader Implications for Russia and the World

Impact on Russia’s oil income

While Russia has worked to diversify its oil export markets—particularly to Asia—the new sanctions raise the prospect of reduced access to Western financial and insurance systems, instrumental for shipping and trading. A recent report noted that Russia’s “shadow fleet” of tankers and anti‑sanction tactics are already under scrutiny. Russia’s budget has been adjusting for lower oil prices and increasing risks—but the war economy still heavily depends on oil export revenue.

Risks for major buyers and intermediaries

Countries that continue to purchase Russian crude or refined products face complication: secondary sanctions or reputational risk. Nations like India and China, major importers of Russian oil, are now in a delicate position. For instance, Indian refiners exporting fuel derived from Russian crude to Europe may face restrictions under EU sanction rules.

Energy security and supply chain realignment

The sanctions accelerate global efforts to reduce dependency on Russian energy—not only for ethical or geopolitical reasons, but also due to reliability concerns. At the same time, they spotlight vulnerabilities in shipping, insurance, and fuel‑logistics systems that underpin global flows.

Also Read: Oil Prices Slide on Oversupply Concerns and Trade Tensions

Strategic Considerations and Challenges

Russia’s counter‑measures

Russia is expected to deepen its economic ties with friendly states and further expand its shadow fleet, older tankers and re‑routing mechanisms to bypass Western oversight. However, these workarounds carry escalating cost and risk.

Cost to global economy and inflation risk

A compressed supply from Russia—or even the threat of it—can push up oil prices, aggravate inflation and pressure energy‑importing economies. Some analysts warn that the global economy may pay a “sanctions price” in the form of higher fuel costs and slower growth.

Enforcement and fragmented compliance

Success depends not just on the headline sanctions but on how robustly they’re enforced worldwide—including shipping, finance, insurance and port systems. Effective enforcement requires coordinated global effort.

The Path Ahead

Watch indicators

- Oil price spreads for Russian‑grade crude (“Urals”) and discount levels vs Brent

- Major buyers’ behavior: India, China, Turkey and others

- Shadow‑fleet activity and tanker insurance flux

- Russia’s export revenue flows and budget resilience

Diplomatic tracks

Will pressure from the sanctions push Russia toward negotiations, or will Moscow retaliate through energy supply cuts or other tools?

Energy transition acceleration

The sanction move may serve as a catalyst for stronger investments in renewables, alternative supply chains and decoupling from Russian fossil‑fuels.

Power with Moral Clarity

In the swirling world of sanctions, supply‑chains, and energy politics, the teachings of Sant Rampal Ji Maharaj offer a guiding light: True power is not measured by control of resources or dominance, but by how responsibly they are used for human welfare and peace. When nations impose sanctions not for retaliation but for restoration of justice and harmony, they align with that deeper purpose. Let this moment serve as a reminder that policy and power must walk hand‑in‑hand with compassion, moral clarity and shared humanity.

FAQs: Sanctions on Russian Oil

Q1. Which companies are targeted by the new US sanctions?

The sanctions target Rosneft and Lukoil, Russia’s two largest oil companies.

Q2. Why did the US take this step now?

The step follows Moscow’s continued war in Ukraine and frustration with stalled diplomacy, with oil revenue seen as a key enabler of the conflict.

Q3. How do these sanctions impact global oil markets?

Markets reacted quickly, with oil prices jumping. The sanctions raise supply‑risk premiums for crude and complicate the transactional mechanics of Russia’s oil exports.

Q4. Are other countries involved or affected?

Yes. Buyers of Russian oil (notably India, China, Turkey) and nations shipping or insuring Russian crude could face secondary risks. The EU is finalising its 19th sanctions package.

Q5. Can Russia bypass the sanctions?

Russia has partially done so via shadow fleets, older tankers and alternate buyers. But these measures increase cost, risk and complexity—and the longer‑term durability remains uncertain.

Discussion (0)